Opening a FAB iSave Account in the UAE is a smart financial move for anyone looking to maximize their savings with ease and convenience. This high-yield savings account, offered by First Abu Dhabi Bank (FAB), provides competitive interest rates, no minimum balance requirements, and the flexibility of online banking. Whether you’re a resident looking to grow your savings or someone seeking a secure and reliable banking option, the FAB iSave Account offers numerous benefits. In this guide, we’ll walk you through the process of opening an iSave account, highlight its key features, and provide tips on how to make the most of your savings. Let’s explore how you can start your journey towards financial growth with FAB.

What is a FAB iSave Account?

The FAB iSave Account is a high-yield savings account offered by First Abu Dhabi Bank (FAB). It is designed to help you grow your savings with competitive interest rates and flexible banking options. The account can be managed entirely online, making it a convenient choice for those who prefer digital banking.

Step-by-Step Guide to Opening a FAB iSave Account

Step 1: Download the FAB Mobile App

The first step in opening a FAB iSave Account is to download the FAB Mobile app. The app is available on both the Android and iOS platforms. You can find it in the Google Play Store or the Apple App Store.

Step 2: Register or Log In

If you are a new customer, you will need to register for an account on the FAB Mobile app. Existing customers can simply log in using their credentials.

Step 3: Select the iSave Account

Once you are logged in, navigate to the accounts section and select the “FAB iSave Account” from the list of available options.

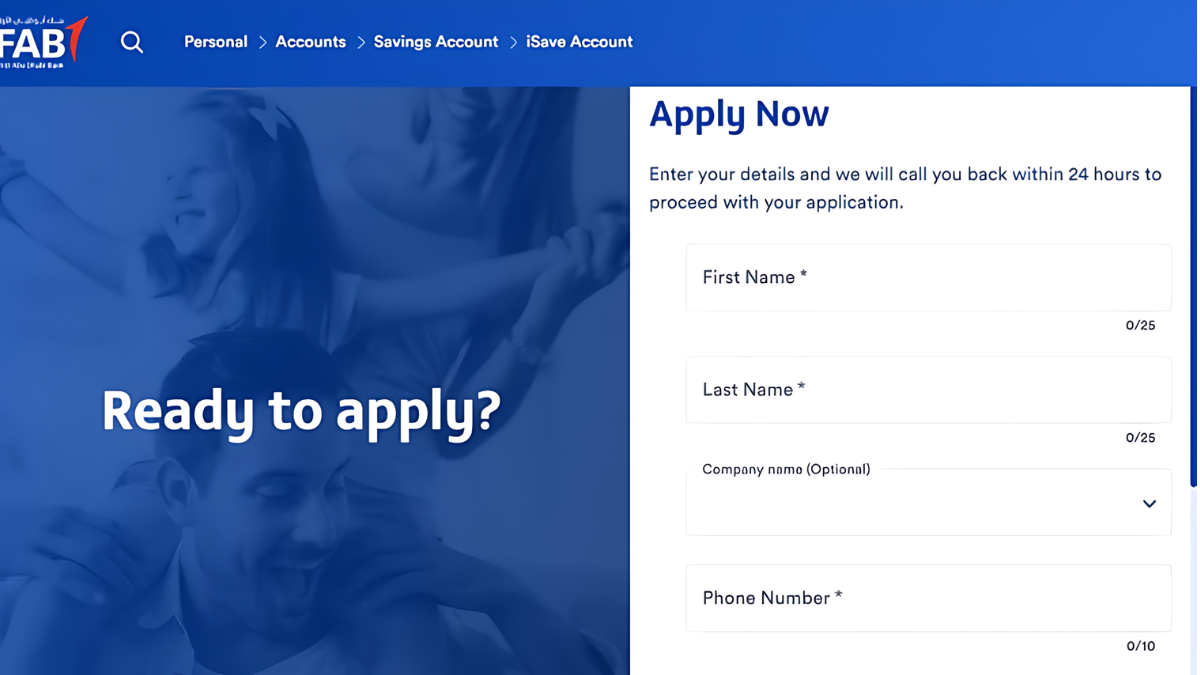

Step 4: Fill in Personal and Employment Details

You will be prompted to fill in your personal and employment details. This includes your name, address, contact information, and employment status.

Step 5: Submit the Application

After filling in all the required details, review your application to ensure all information is accurate. Once you are satisfied, submit the application. Your account will be activated promptly, and you will receive a confirmation notification.

Step 6: Fund Your Account

To start earning interest, you need to deposit funds into your new iSave Account. You can transfer money from another bank account or deposit cash at a FAB branch.

Also Read: MonkeyGG2 | Yankees vs Toronto Blue Jays Player Stats Regular Season(4 August, 2024)

Why Open a FAB iSave Account in the UAE?

- High-Interest Rates: Earn up to 5.25% per year on new funds, one of the highest rates in the UAE.

- No Minimum Balance: No need to maintain a minimum balance, making it accessible to everyone.

- No Monthly Fees: Enjoy zero monthly maintenance fees, allowing you to save more.

- Unlimited Withdrawals: Make unlimited withdrawals without any restrictions.

- Online Convenience: Open and manage your account entirely online through the FAB Mobile app or online banking.

- Instant Account Opening: Existing FAB customers can open an iSave account instantly.

- Secure and Reliable: Benefit from the security and reliability of First Abu Dhabi Bank, one of the leading banks in the UAE.

Eligibility Requirements

To open a FAB iSave Account, you must meet the following criteria:

- Residency: You must be a UAE resident with a valid Emirates ID.

- Age: You must be at least 18 years old.

- Documentation: You will need to provide a copy of your Emirates ID, passport, or resident visa, along with proof of income such as a salary slip or income certificate.

Security Features

- Two-Factor Authentication (2FA): Adds an extra layer of security to your account.

- Secure Online Transactions: All transactions are encrypted to protect your personal information.

- Fraud Detection Systems: Advanced systems to detect and prevent fraudulent activities.

- Regular Security Updates: Continuous updates to ensure the highest level of security.

Promotional Offers

- High-Interest Rate: Earn 5.25% interest per year on new funds deposited from May 1, 2023, to September 30, 2024.

- FAB Rewards: Use your FAB Rewards to pay bills and make purchases.

- Cashback Offers: Earn up to AED 12,500 cashback when you transfer your salary, get a credit card, open an iSave Account, and take out a personal loan, home loan, or car loan with FAB

Managing Your FAB iSave Account

Once your account is active, you can manage it entirely online. The FAB Mobile app and online banking platform offer a range of features to help you manage your finances:

- Check Your Balance: Easily check your account balance and transaction history.

- Transfer Funds: Transfer money between your accounts or to other bank accounts.

- Set Up Alerts: Set up alerts for account activity, such as deposits and withdrawals.

- Pay Bills: Use your FAB Rewards to pay bills directly from your account.

Tips for Maximizing Your Savings

- Regular Deposits: Make regular deposits to take full advantage of the high-interest rates.

- Monitor Interest Rates: Keep an eye on the interest rates and any promotional offers to maximize your returns.

- Utilize Online Tools: Use the online tools and calculators provided by FAB to plan your savings and track your progress.

Conclusion

Opening a FAB iSave Account in Dubai is a simple and efficient way to grow your savings. With high-interest rates, no minimum balance requirements, and the convenience of online banking, the FAB iSave Account is an excellent choice for anyone looking to maximize their savings potential. Follow the steps outlined in this guide to open your account today and start enjoying the benefits of one of the best savings accounts in the UAE.

Also Read: 127.0.0.1:57573: Meaning, Troubleshoot Common Error and Fixing Tips | France National Football Team vs Poland National Football Team Stats, Euro 2024

FAQs

What is the interest rate on the FAB iSave Account?

The interest rate is up to 5.25% per year on new funds deposited.

Is there a minimum balance requirement?

No, there is no minimum balance requirement.

Are there any monthly fees?

No, there are no monthly maintenance fees.

Can I make unlimited withdrawals?

Yes, you can make unlimited withdrawals without any restrictions.

How do I open an iSave Account?

You can open an account instantly through the FAB Mobile app or online banking.

What documents are required to open an account?

You will need a valid Emirates ID, passport, or resident visa, and proof of income